Introducing service design to refocus a government service on customers.

Challenge

The Retirement Services team at the Office of Personnel Management came to the Lab at OPM with a request to redesign its Retirement Handbook, a booklet that goes to all federal retirees after their retirement is processed. Before diving in on the redesign, we advocated for a short research sprint to make sure we had a clear understanding of the context and to ensure we were targeting the right problem. That research uncovered that most retirees were pretty satisfied with the booklet itself, the issue was that it often arrived after 6 months of anxiety and stress in which there was very little communication about their retirement. We reframed the design challenge to focus on “how we might help new customers to understand the retirement process, know what to expect, and avoid feeling lost in the bureaucracy?”

Example of a theme that emerged from our research.

Mapping insights and existing touchpoint to the customer journey revealed a gap in setting expectations and explaining the process early in the retirement journey.

Process

Our initial research leveraged existing documents and survey data and combined them with qualitative interviews of 20 annuitants from 12 different Federal agencies, as well as interviews with Retirement Services call center and processing staff. We looked at all the data both thematically and temporally, and created a customer journey map that mapped existing annuitant touchpoints to the feelings and pain points we learned about in our research. This exercise revealed that there was. a clear gap early in the customer journey in which the agency was not setting expectations or explaining the retirement processing timeline, leading to dissatisfaction and frustration for customers later in their journey.

We then facilitated several workshops on principles of good service design to help the Retirement Services team pivot from focusing on a booklet (a single touchpoint) to focusing on the end-to-end service they were delivering.

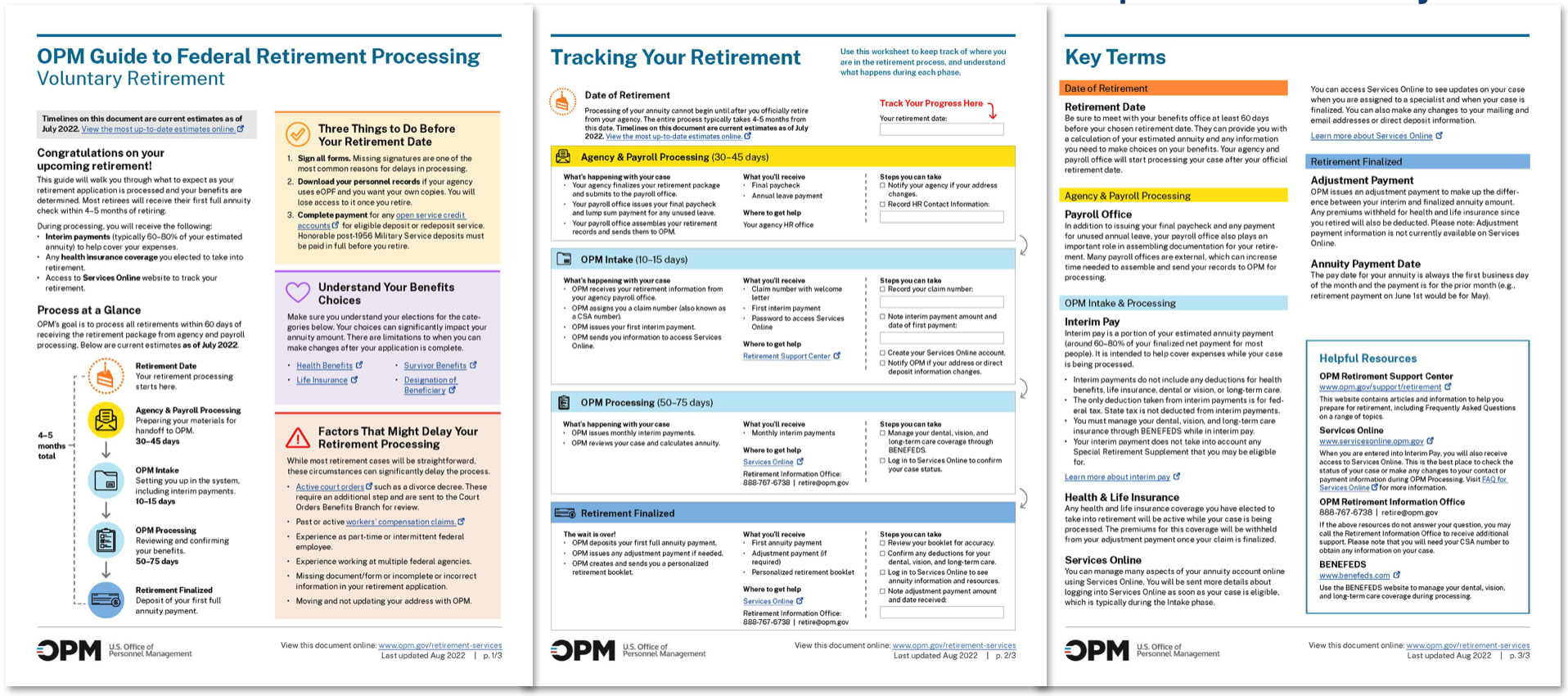

Before we could develop any solutions, we knew we needed to get alignment across the agency on a simple explanation of a very complicated and bureaucratic retirement process. However, through a series of carefully facilitated co-design sessions with the Retirement Services team, we developed prototypes of two new concepts - The Guide and The Tracker. The Guide was a short guide for new employees preparing to retire that would clarify the process and how long it would take to finalize their retirement. The Tracker was an interactive document to help newly-retired employees to monitor their progress, including where to reach out for help at each stage.

We conducted testing sessions for the prototypes with potential customers, Retirement Services staff, and agency benefit officers. We leveraged their feedback to iterate and create the “Quick Guide” that combined the best elements for each prototype and addressed issues from testing.

Outcome

We presented the revised prototypes to the Retirement Services leadership team. A key component of the design was a realistic timeline of retirement finalization based on current data of processing times. This would include admitting to customers that retirement processing would take 4 to 6 months, far longer than the agency’s goals for processing. When leadership asked about removing the data, the Retirement Services team spoke up and advocated about the importance of setting expectations for customers as a core principal of effective service design. Agency leadership agreed to pilot the new Quick Guide with agency partners.

Since the end of our project, the Retirement Services team has continued to iterate on the concept and has created a digital PDF, a website, and a video to support the effort. The Quick Guide has also been distributed to all agency partners.

The final prototype of the Quick Guide that included an estimate of processing time, an explanation of the process, and a tracker to follow along with your progress.

Project team: Kelly Bryan, Erika Lindsey, Andrew Lee